Illinois offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Keep Warm Illinois

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Illinois Government

Office of the Secretary of State

213 State Capitol

Springfield, IL 62756

(800) 252-8980

Hours: M-F 8:00am – 5:00pm

ComEd (Commonwealth Edison Company)

ComEd Customer Care Center, P.O. Box 805379,

Chicago, IL 60680-5379

Residential Customer Service

(800) 334-7661

Business Customer Service

(800) 426-6331

Hours: M-F 7:00am – 7:00pm

Illinois EPA – Office of Energy

1021 North Grand Ave. East

Springfield, IL 62794-9276

(217) 782-3397

[email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Chicago Weather Bureau

333 West University Drive

Romeoville, IL 60446

(815) 834-1435

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| Property Tax Exemption | 100% of increase property value | Individuals who install a residential solar system |

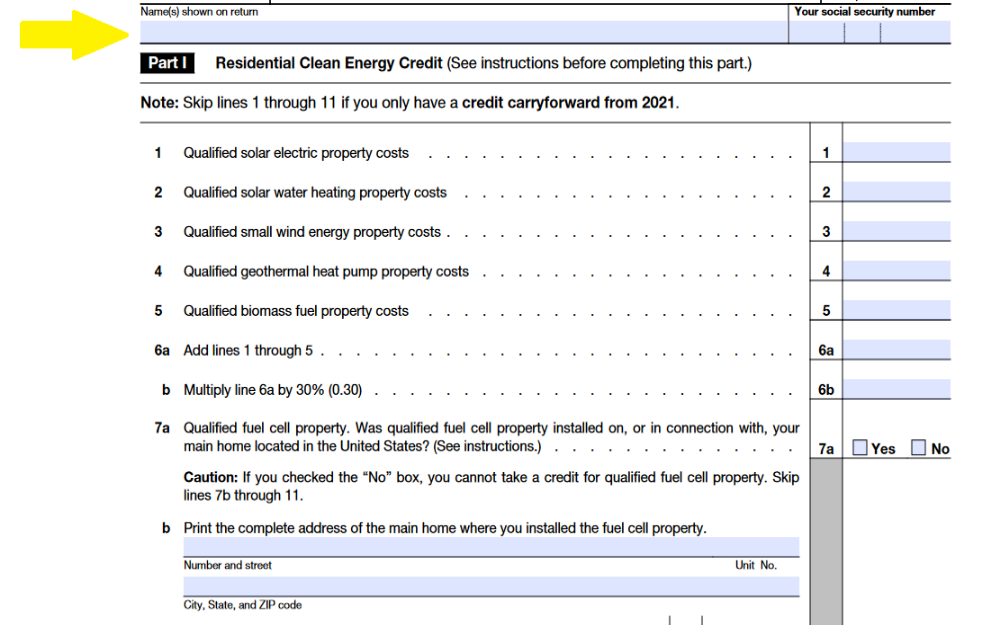

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Illinois Clean Energy

Residential Solar Program

Community Solar Program

Non-Profit and Public Facilities Program

Solar and Shines Incentives

Utility Bill Assistance

Home Weatherization

Contact

Power Outage Map

Illinois Environmental Protection Agency

Phone: (217) 782-3397

Email: [email protected]

Monday – Friday

9 AM – 5 PM

1021 North Grand Ave. East

P.O. Box 19276

Springfield, IL 62794-9276

Understanding Illinois Solar Incentives and Options

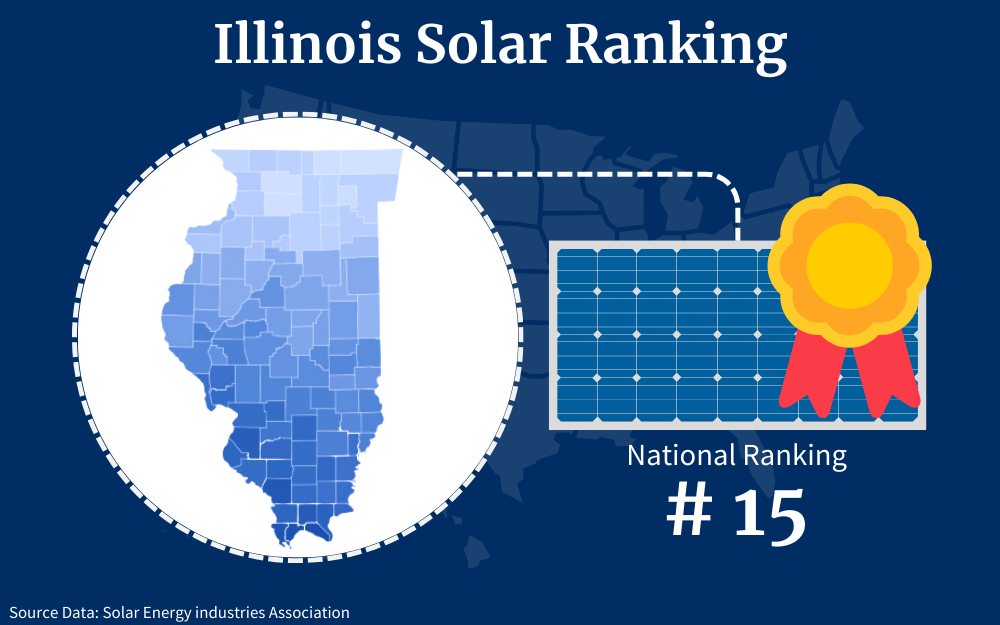

With the state ranking in position number 15 for the overall installation of solar power, Illinois is seeking ways to encourage more renewable energy adoption.10

The solar incentives and rebate programs are designed to make the transition easier by lessening the strain on your bank balance and offering innovative options guaranteed to convince you that going solar now rather than later is a good idea.

And the federal government is also extending a helping hand with the ITC program.

This complete guide explains how to register for solar tax credits in Illinois and outlines the steps for taking advantage of all the Illinois solar incentives available for residents in the state.

With solar’s fast expansion in Illinois, more and more residents may expect to see financial benefits from making the switch to renewable energy.

On average, residents can save money in the long run by switching to solar energy since the state has among of the lowest installation costs in the country and one of the lowest energy rates. And some pretty interesting incentive programs.

Illinois SREC Incentive: The Adjustable Block Program

This incentive scheme paves the way for more solar power development in the state, opening the doors for community solar projects and Distributed Generation (DG) programs, which are now both eligible for the development incentives under the program.

Long-term contracts of 15 years between a utility provider and an authorized vendor are signed where a fixed price is stipulated for the purchase of Renewable Energy Credits (RECs), with one credit being attributed for every one megawatt-hour (MWh) generated.

So how does it work?

Approved vendors represent solar project owners and participants in community programs in the Adjustable Block Program. They are responsible for submitting compliance paperwork for each of their clients and providing ongoing information and updates for all parties.

RECs serve a crucial role in accounting, tracing, and assigning ownership to renewable energy production and consumption since the physical electricity uploaded tells nothing about its origin, how, or where it was created.

Customers on a shared grid require RECs as proof that they are using renewable resources such as solar energy, regardless of whether that electricity was generated locally or remotely at another location.9

Each MWh of power generated by your solar system qualifies you for one solar renewable energy certificate (SREC) that can be valued at $300 or more, and a typical home in Illinois could produce 6 to 7 RECs a year.

That would give a value of about $2,000 that can be claimed under the Adjustable Block Program, also commonly known as Illinois Shines, a popular Illinois solar incentive.

The RECs available have fluctuating prices based on produced electricity and if that quantity was maintained over the term of the agreement, it would literally pay for your home solar energy system.

To check the most current pricing model, visit this report from Illinois Power Agency.11

To enroll in the program, contact a solar company that will be able to sign you up or point you in the direction of an approved vendor who can provide the solar credit form.

Illinois Solar for All (ILSFA)

The Illinois Solar for All (ILSFA)16 program is a three-tiered initiative aimed at assisting low-income individuals and groups who are interested in solar energy but financially find it difficult to participate in what is essentially a solar revolution.

These community solar initiatives make going solar an option for low-income homeowners, non-profit organizations on a budget, and even government buildings.

Participants who qualify based on income get free solar panels installation and subscription and can expect to reduce their monthly power costs very quickly.

The funding is achievable due to partnerships with recognized suppliers who, in exchange for Renewable Energy Credits (RECs), make the program viable for all interested parties.

These businesses may make a small profit from the sale of RECs and then pass those savings on to homeowners in the form of lower energy bills. Some households have managed savings of $1,000 a year with the added benefit of not having any upfront costs at all.

The advantages of each program are unique, and tailored specifically for each target group.

To be eligible you have to be earning 80% or less of the local median income and can apply on the ILSFA website for this Illinois solar incentive.

Property Tax Break

This tax break is an important one because the last thing any homeowner wants is to improve the value of their property by installing a brand new photovoltaic energy system (PV cells) and paying higher property taxes.

This tax break recognizes the property owner’s commitment to using a renewable green electricity energy source so you will not be penalized for installing photovoltaic solar panels.

To apply for the exemption, fill in form PTAX-330 with your county assessor.4

Illinois Net Metering

Are solar panels worth it in Illinois? The net metering policy in Illinois ensures that your utility provider will reimburse you for any power your solar system generates that is not consumed by your household.

Since power generation and consumption do not always occur at the same time, meaning that solar energy is absorbed during the day and expended more during the evening, net metering is a terrific approach to make sure you get the most out of your solar panels.

In Illinois, net metering works on a credit system for users who produce up to 40 kilowatts of power from their systems. Since most home solar installations produce less than 10 kilowatts they will all be eligible for the scheme.

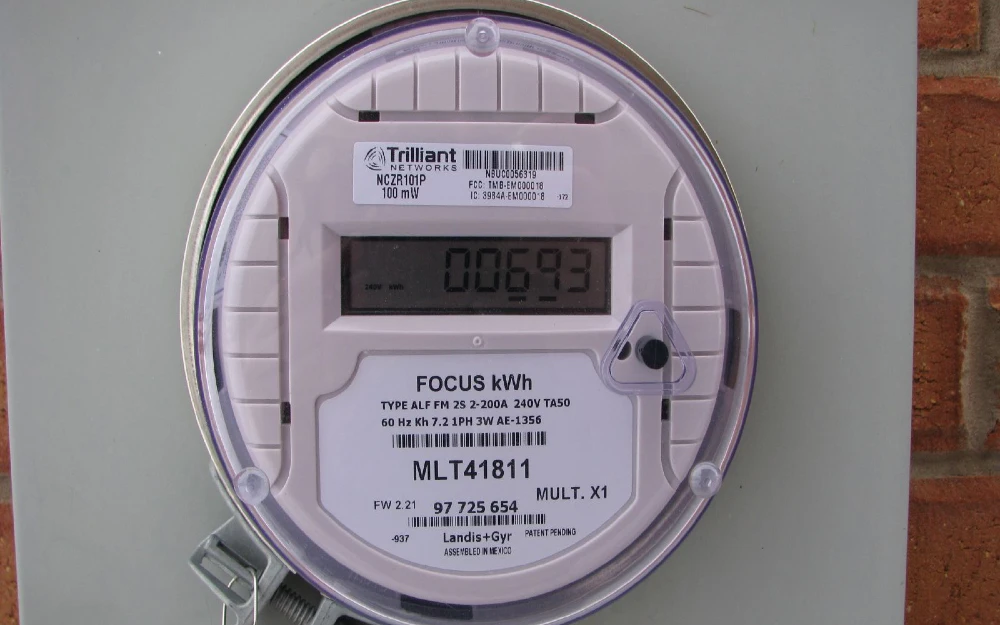

Sign up for the program through your solar company or with your local provider and, if your solar array generates more energy than your house uses from the grid in a given month, you will be credited at the same rate that you would be charged by the utility provider had you drawn electricity from the grid.

Credits on your bill will accumulate month-to-month over the course of the year through a bi-directional meter installed in your home. This smart meter will record every watt going in and out of your home and what is consumed by your appliances.

Your utility provider will send you a statement after 12 months that includes any over-payment credits you are owed, which will carried over.

It costs nothing to sign up but reduces your monthly utility bill nicely, thanks to this additional bonus of Illinois solar incentives.

The Federal Solar Tax Credit

The installation of solar power in Illinois and in every state across the country is supported by the Federal solar tax credit initiative.

A 30% discount on your PV solar energy system thanks to the investment tax credit (ITC) is hard to ignore. The average price of a solar system in Illinois with a capacity of 9-kW is approximately $28,44012 and the tax credit levied against that amount is a substantial saving.

The program is currently officially called the Residential Clean Energy Credit for residential installations, but it’s not open to everyone.2 It is only available to those who pay for their PV system in full either with cash or a solar loan, and not to those who are either renting or leasing.

You must also be employed and actually have taxes due to be paid so the credit can be deducted from them to reduce the monies you have to pay to the government.

If your taxes are more than the 30% deduction of the sales price from your $28,440 photovoltaic solar electric investment, $8,532, then you can offset the entire amount.

If your liability is less, the remainder of the $8,532 credit can be rolled over for up to 5 years. However, if there are any funds that remain unclaimed after this time period, they will be lost to you.

There are some points for eligibility:

- The location where the solar system is installed must be within the United States.

- You must be the owner of that property, whether it’s an apartment, a condominium, a mobile home, or a houseboat.

- The premises have to be your primary residence and you have to be the owner on record.

- You need to be the legal owner of the system in order to participate. That rules out renting or leasing, but a loan-financed purchase contract would be OK.

US Dept of Energy Solar Options

Building a sustainable energy economy that benefits all Americans is one of the goals of the Office of Energy Efficiency and Renewable Energy (EERE).

Through the Inflation Reduction Act and the Bipartisan Infrastructure Law, the federal government is investing in the future of renewable energy in a way that has never been done before.8

Homeowners who are interested in saving money on solar energy may take advantage of a number of different programs, both initially and in the long run, and some of them may be combined if desired.

The ITC reduces the amount of federal taxes due from tax-paying homeowners who install solar energy systems.

You can get a 30% tax credit that you can offset against your tax liabilities over a 5-year period.

Renewable Energy Certificates (SRECs)

SRECs are purchased by utilities and are worth whatever the market is willing to pay per megawatt-hour (MWh) of solar-generated energy, crediting the participant with one credit per MWh. In addition to the money saved on power costs, homeowners and businesses may earn and sell SRECs.

Property and Sales Tax Exemption

Illinois has a property tax exemption so that you will not be taxed on the increased property value from installing solar panels, but the state does not offer a sales tax exemption.

If you live outside of Illinois, it’s worth verifying if this exemption is available in your area.

Tax Rebate

Many states now provide their own solar tax credit to homeowners in addition to the federal benefit. In South Carolina, for instance, you may get a tax credit equal to 25% of the cost of a solar system and carry over any unused portion for up to 10 more years.

Rewards for Good Performance

With a Performance-Based Incentive (PBI), homeowners are compensated over time for the solar energy they generate and relay back into the grid rather than receiving a lump sum refund.

The PBI is calculated using the contractual energy rate per kilowatt-hour and may be combined with additional incentives.

Only a few states now implement Feed-in Tariffs (FITs), and unfortunately, Illinois is not one of them.

Utility Discounts

Electricity utility providers may often provide a refund to homeowners who want to install solar panels or other forms of solar energy technology on their property. Rebates are upfront incentives offered by many businesses and are often obtained via the customer’s utility provider.

There are several formats for rebates can take.

A direct cash payment might be made depending on factors including system size, installation needs, and the kind of consumer. They may also be offered a refund that is determined by the quantity of energy produced by the solar system.3

To qualify for a rebate, homeowners must normally fill out an application and provide proof of their solar system’s installation. Depending on the utility provider and geographic area, refunds on utility costs might range from zero to several hundred dollars.

Some utility companies in Illinois offer a rebate program. Enquire with your provider to take advantage of their generosity if they offer it.

Low-Interest Loans From the USEA

Some homes may be able to get grants or low-interest loans to cover the expense of going solar, and this option provides more financial freedom to borrowers for their solar energy purchases.

Loans that qualify for subsidies or incentives generally have reduced interest rates and more flexible repayment choices, such as longer payback periods, lower monthly installments, or the ability to delay payments altogether.

If you’re wondering how to get solar panels for free, then grants are as close as you can get.

The following government organizations provide grants or other forms of financial aid to households that install solar energy systems:

- United States Energy Administration

- United States Treasury

- Health and Human Services Division, United States Government

- Dept. of Transportation, U.S.

- HUD (Housing and Urban Development of the United States of America)

The majority of programs have easily accessible online application guides and forms. To make life easier, most solar energy installers will file the necessary paperwork for any rebates or tax credits on your behalf.

Application Process for Energy Tax Credit

Either your tax accountant or your solar provider can help you fill out the forms required to apply for the available tax credits, both state and Federal.

To apply for the ITC, the solar credit Form 5695 can be filled in online, printed, and submitted with your other paperwork. This can only be done after the home solar energy system is installed and fully paid for as details such as final cost, location, quantity, size of panels, and your provider, will have to be included.

You may ask, “What if my home is also a business location, how does the tax credit work?”

Pretty much the same as for a residential property with one minor change.

If you used an example of a company with earnings of $100,000 with a tax rate 37% tax rate, the taxable amount would be $37,000.

The ITC would immediately reduce that to $7,000, meaning that the system would have cost $77,000 after the deduction. But for businesses, there are more credits available.

- There is a credit of 10% if at least 40% of the components of the solar system were made in the USA.

- If the site or business address is in an energy community, defined as having brownfield sites or in areas where coal plants have been closed down, then there is another 10% credit.

- A further 10% credit is given if the project is situated in an area with a low median household income or on tribal property and has a capacity of less than 5 MW.

- If the PV is installed as part of a low-income housing development or economic benefit scheme for your new business, and the project’s total capacity is less than 5 MW, another 20% credit can be claimed.

That amounts to an incredible 50% that can be deducted from your taxes over the next 5 years, reducing the remaining cost from $77,000 to $38,5000. But if that amount is used before the ITC, then the final cost of the PV would be just $20,000, down from $100,000.

And that’s an incredible saving.

To claim the Federal Solar Tax Credit (ITC), all you need to do is fill out IRS Form 5695 with the information given by your solar installer and submit it to the IRS.

More steps below:

Step 1. Gather your documents: Before you start, ensure you have all the necessary documents, such as receipts and records related to your solar energy system installation, including costs, dates, and specifications.

Step 2. Download Form 5695: Visit the IRS website to download the most recent version of Form 5695.

Step 3. Complete the basic information: At the top of the form, provide your name, Social Security Number (or Taxpayer Identification Number), and address.

Step 4. Review and double-check: Before submitting your tax return, review all the information on Form 5695 for accuracy. Mistakes or omissions could delay your tax refund or result in penalties.

What Materials and Parts Do You Need for Solar Panel Systems?

In Illinois, the price of a solar panel installation project averages around $28,440, and the equipment needed for the installation includes:

- Solar panels

- Inverters

- Monitoring screens

- Racking

- Junction box

- Charge controllers

- Battery bank

- Cables

These components can influence the prices in either direction.

Not all houses need battery storage so eliminating those can reduce the price, just as the requirement for more power would result in more solar panels needed, which would increase the price.

How To Use a Residential Solar Panel Calculator

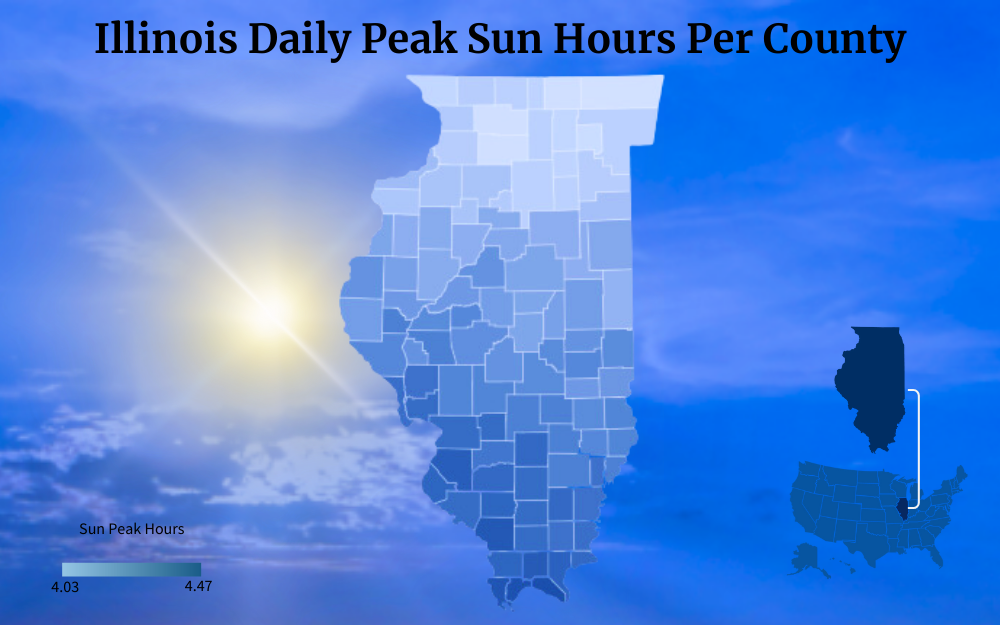

The energy consumption in your property will determine how many solar panels will be needed. To calculate that amount you will need to know the peak sun hours a day in your state, and the monthly and yearly electricity of your property.

The average monthly electricity usage of an Illinois home is 728 kWh or 8,736 kWh annually, and 4 hours is the average peak sun hours in the state that your arrays are able to absorb.6,13

Using the average-sized solar panel of 400 kWh, calculations can then be done by using this formula:

- 728(mth kWh) / 120(mth sun hours) = 6.1 kW

- 6.1 X 1,000 = 6,100 watts

- 6,100 / 400 (kWh panel) = 15.25 panels or 16 panels

Keep in mind that the original ratings for solar panels are established in an ideal production environment. Because not every day will have ideal solar conditions, the actual panel output of 400 kWh will be lower once installed.

Therefore, when estimating the number of solar modules you’ll need for your house, you should increase the final figure by 25%, to increase the panels to 20.

A residential solar power calculator such as the one below will help with the solar estimate for your panels and also what the payback period could be.

In Illinois, it can take between 9 to 15 years before a photovoltaic system has paid for itself.

For example, if your system costs $15,000 after all reductions and saves you $1,500 a year, that means that your payback period will be:

- 15,000 / 1500 = 10 years

Once you reach that milestone, you will then be generating free electricity as the system would have paid for itself through the utility savings.

Can You Make Money From Net Metering?

Not exactly.

The power produced by your solar panels cannot be sold to the grid for money but only credited toward your utility bill.

Solar energy has several advantages one of which is its green credentials for climate change, and saving money is one of its main achievements rather than making money.

But if you consider that the average kWh rate from the grid in Illinois is 15.13c/kWh,13 net metering could reduce that rate to 12c/kWh or less depending on the credits accrued, resulting in an immediate saving.

A smart meter in your home would automatically calculate the kWh used from your solar system and the credits returned, and calculate what your ultimate kWh price is per month – and how much you have saved.

Some entrepreneurs, however, have set up businesses where an off-site solar installation sells a portion of the energy generated to subscribers at a lower rate than they would receive from the power company.

This system of net metering involves signing a PPA (Power Purchase Agreement) for the supply of electricity from an off-site utility-scale project, or even an on-site system.

In this situation, the developer pays for the installation and upkeep of the system so the homeowner possibly has no upfront expenses, depending on the terms of the contract, and receives the kWh rate at a cheaper price than the grid, all monitored by the smart meter.1

In whichever scenario for the homeowner, net metering is not a money-making goldmine, but a money-saving solution over the solar panel lifespan.

Contractor Requirements for Home Solar System Installation

Choosing a contractor in Illinois to get a solar estimate can mean contacting over 340 companies in the state to get the best price. That’s a lot of companies to wade through.

Under these conditions, the process of elimination is your best option.

Before starting, estimate how many panels you will need, and then select a few installers in your area and research how long they have been fitting photovoltaic systems.5

- Always check their credentials and certifications to verify how competent they are. Are they certified by the North American Board of Certified Energy Practitioners?17

- Do they offer financing options, leasing, or PPAs?

- Do they have solar cover? Does the business have all the proper licensing and insurance?

- Don’t be afraid to ask if they have completed similar works in the region or if you can visit a prior installation to see how they did their work.

- Ask about how comprehensive the warranty is so that any problems with solar panels fitted by them will be covered. Ask how long it lasts as this can vary from installer to installer

- Find out how long they have been in business. A company that started 2 months ago is less likely to be around to solve any problems with solar energy supplies than one that has already been in business for 20 years.

Doing your due diligence may take a bit of time, but qualifying that the company you eventually choose adheres to all the solar panel regulations, will put your mind at ease.

There have been over 60,000 solar installations in Illinois with an investment of around $3 billion to date, including large-scale utility enterprises thanks in part to the numerous incentives on offer in the state.10

As climate awareness increases, the benefits of these clean, renewable energy sources that are effective are becoming widely popular, and thanks to Illinois solar incentives, residents have big saving options for installing home solar systems in the state and reducing their energy costs for many years to come.

Frequently Asked Questions About Illinois Solar Incentives

Why Are Solar Panels Good for the Environment?

The questions “how does solar panel help the environment?” or “why are solar panels good for the environment?” are always good questions to ask. It is undeniable that carbon emissions and other environmental pollutants are adversely affecting the planet and using solar energy to create energy instead of traditional methods that burn fossil fuels is cleaner, greener, and leaves no carbon footprints.

How Long Do Solar Panels Last?

If you buy solar panels note that across the solar industry, the useful lifespan of solar panels is between 25 to 30 years. But how long solar panels last also depends on the quality of the build and proper maintenance throughout its life.

Are Solar Panels Toxic?

Solar panels are not toxic but there are some hazardous materials inside that can potentially leak when old panels are disposed of. But if you’re wondering are solar panels toxic in Illinois, don’t worry because the state is starting recycling initiatives to repurpose old panels that in some states would just end up discarded and rusting away in landfills.7

References

1California Public Utilities Commission. (2023). The Benefits of Smart Meters. California Public Utilities Commission. Retrieved August 31, 2023, from <https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/infrastructure/the-benefits-of-smart-meters>

2Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. Internal Revenue Service. Retrieved August 31, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

3Montclair State University. (2023). Solar Energy. Montclair State University. Retrieved August 31, 2023, from <https://www.montclair.edu/clean-energy-sustainability-analytics/resources/clean-energy-information/solar-energy/>

4Morris, J. (2023, February 2). Renewable Energy. MIT Climate Portal. Retrieved August 31, 2023, from <https://climate.mit.edu/explainers/renewable-energy>

5North Carolina State University. (2022, June 28). Tips for Financing A Successful & Sustainable Residential Solar Photovoltaic System. NC Clean Energy Technology Center. Retrieved August 31, 2023, from <https://nccleantech.ncsu.edu/2022/06/28/tips-for-financing-a-successful-sustainable-residential-solar-photovoltaic-system/>

6University of Central Florida. (2023). Cells, Modules, Panels and Arrays. FSEC Energy Research Center. Retrieved August 31, 2023, from <https://energyresearch.ucf.edu/consumer/solar-technologies/solar-electricity-basics/cells-modules-panels-and-arrays/>

7University of Illinois Board. (2023). Solar Panel Recycling Initiative. Illinois Sustainable Technology Center. Retrieved August 31, 2023, from <https://tap.istc.illinois.edu/programs/renewable-energy-equipment-recover-reuse-program/solar-technology/solar-panel-recycling-initiative/>

8U.S. Department of the Interior Indian Affairs. (2023). Inflation Reduction Act. U.S. Department of the Interior Indian Affairs. Retrieved August 31, 2023, from <https://www.bia.gov/service/tribal-consultations/inflation-reduction-act>

9U.S. Environmental Protection Agency. (2023, February 5). Renewable Energy Certificates (RECs). U.S. Environmental Protection Agency. Retrieved August 31, 2023, from <https://www.epa.gov/green-power-markets/renewable-energy-certificates-recs>

10Solar Energy Industries Association. (2023). Illinois Solar. SEIA. Retrieved September 11, 2023, from <https://www.seia.org/state-solar-policy/illinois-solar>

11Illinois Power Agency. (2023, April 20). Illinois Power Agency Releases 2023-2024 Renewable Energy Credit Prices and Rationale for Illinois Shines and Illinois Solar for All Programs. IPA. Retrieved September 11, 2023, from <https://ipa.illinois.gov/content/dam/soi/en/web/ipa/documents/rec-prices-rationale-41923.pdf>

12Aggarwal, V. (2023, May 1). How much do solar panels cost in 2023? Energy Sage. Retrieved September 11, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/>

13U.S. Energy Information Administration. (2023, June). Electric Power Monthly | Table 5.6.A. Average Price of Electricity to Ultimate Customers by End-Use Sector. EIA. Retrieved September 11, 2023, from <https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a>

14Smart Meter Photo by Miherco / Attribution-ShareAlike 2.0 Generic (CC BY-SA 2.0). Cropped, Resized and Changed Format. From Flickr <https://www.flickr.com/photos/miheco/5140563710>

15Internal Revenue Service. (2023). Form 5695. IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

16Illinois Solar for All. (2023). Residential Solar. Illinois Solar for All. Retrieved September 13, 2023, from <https://www.illinoissfa.com/programs/residential-solar/>

17North American Board of Certified Energy Practitioners. (2023). NABCEP Homepage. NABCEP. Retrieved September 13, 2023, from <https://www.nabcep.org/>